Nationwide Car Insurance: Insights from a Longtime Customer

Taudiry.com Hai semoga hatimu selalu tenang. Pada Blog Ini aku mau berbagi cerita seputar Insurance yang inspiratif. Tulisan Tentang Insurance Nationwide Car Insurance Insights from a Longtime Customer Jangan diskip ikuti terus sampai akhir pembahasan.

Nationwide Car Insurance: Insights from a Longtime Customer - When it comes to car insurance, making the right choice can feel like trying to navigate through a maze blindfolded. After all, nobody wants to think about what happens if they get into an accident, but we all know it’s a possibility. Having been with Nationwide for a while now, I can share some insights and personal experiences that might help you decide if they’re the right fit for you.

Understanding Nationwide’s Coverage Options

First off, let’s talk about the variety of coverage options Nationwide offers. They’ve got the basics covered—liability, collision, and comprehensive insurance—but what really caught my eye were their additional coverage options.

I remember when I first got my policy; I opted for roadside assistance. It was a lifesaver when my car broke down on a desolate highway during a road trip. I had a flat tire, and instead of panicking, I simply called Nationwide’s 24/7 support. Within no time, a friendly technician showed up to help me out. This kind of peace of mind is invaluable, especially if you love hitting the open road like I do.

Discounts that Make a Difference

Nationwide offers several discounts that can save you some serious cash. There’s a good chance you’ll qualify for at least one or two. For example, I took advantage of the multi-policy discount when I bundled my auto and home insurance. It knocked a nice chunk off my premium!

They also have a “SmartRide” program, which gives you the chance to earn discounts based on your driving habits. I decided to give it a shot a couple of years ago. The device they sent me tracked my driving behavior—hard braking, speed, and even how often I drove at night. It was a little intimidating at first, but I soon found it helped me become a more mindful driver. In the end, I saved about 10% on my policy.

Claims Process: A Smooth Ride or Bumpy Road?

If there’s one thing that really stands out about Nationwide, it’s their claims process. I’ve had to file a claim a couple of times, once for a minor fender bender and once for some hail damage. Both experiences were pretty straightforward. I submitted my claim online, and I was pleasantly surprised by how quickly they responded.

What I appreciated the most was the clear communication. I was kept in the loop through each step of the process, from the initial assessment to the approval of the repairs. I’ve heard horror stories from friends about waiting weeks or even months for their claims to be resolved, so I feel fortunate that I didn’t have to deal with that.

Customer Service That Goes the Extra Mile

Another aspect where Nationwide shines is their customer service. Anytime I’ve called with questions—whether about my policy details or just to inquire about adding coverage—the representatives have always been friendly and knowledgeable.

I remember calling once about adjusting my deductible. I was thinking of raising it to lower my monthly premium. The rep didn’t just give me a quick answer; she took the time to explain how it would impact my out-of-pocket costs in case of a claim. It’s these small details that make you feel like they genuinely care about their customers, rather than just making a sale.

Navigating Online Tools and Resources

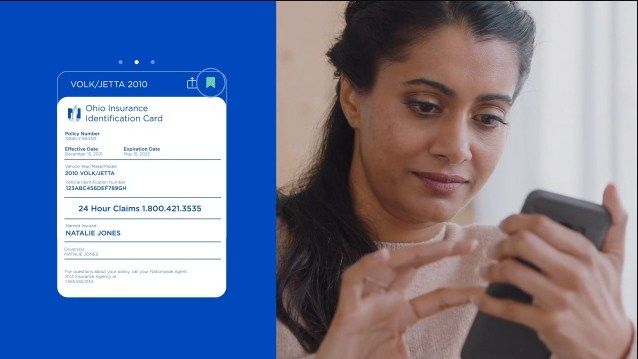

In today’s tech-savvy world, having user-friendly online tools is a must. Nationwide’s website and mobile app are pretty handy for managing your policy. I love that I can easily access my digital insurance card, file a claim, or make payments without having to call anyone.

A few months ago, I needed to update my address after moving. It was so simple; I logged in, made the change, and I was done in minutes. Having these tools at my fingertips makes managing my insurance a breeze.

What to Watch Out For

Of course, no company is perfect. One thing I’ve noticed is that Nationwide’s rates can sometimes be a bit higher than other providers. When I was shopping around, I got quotes from a few different companies, and while Nationwide offered great coverage, I did find lower premiums elsewhere.

That said, it’s all about finding the right balance between cost and quality. For me, the exceptional service and coverage options have outweighed the higher cost. Just make sure to do your homework and get a few quotes before settling on one provider.

The Bottom Line on Nationwide Car Insurance

Overall, my experience with Nationwide car insurance has been pretty positive. Their wide range of coverage options, strong customer service, and easy-to-navigate online tools have made them a reliable choice for my insurance needs. Of course, the decision on what insurance provider to go with is a personal one—based on your needs, budget, and preferences.

But if you’re looking for a company that’s committed to its customers and offers a variety of coverage options, I’d definitely recommend giving Nationwide a closer look. You never know; they might just become your go-to insurance provider, too!

| Coverage Type | Details | Discounts Available |

|---|---|---|

| Liability Coverage | Covers damage to others | Multi-policy discount |

| Collision Coverage | Covers your car after an accident | Safe driving discount |

| Comprehensive Coverage | Covers theft and damage | SmartRide program |

| Roadside Assistance | 24/7 support for breakdowns | New vehicle discount |

| Personal Injury Protection | Covers medical expenses | Good student discount |

Demikian nationwide car insurance insights from a longtime customer telah saya jabarkan secara menyeluruh dalam insurance Semoga artikel ini menjadi langkah awal untuk belajar lebih lanjut tingkatkan keterampilan komunikasi dan perhatikan kesehatan sosial. Bantu sebarkan pesan ini dengan membagikannya. jangan lupa baca artikel lainnya di bawah ini.

✦ Tanya AI